In every interaction we have with clients, conference attendees, or participants in our research, we…

Gen Z spending power reached $360 billion

Gen Z has been grabbing headlines for a while for their willingness to subvert expectations thanks to their markedly different attitudes and responsible approach to money. Yet, brands, retailers, and other companies that target Gen Zers have struggle to keep up with an important figure – how much money does this generation actually have? Not an easy question. Every year there are more Gen Zers who come of age, graduate from school, and join the workforce as well as Gen Zers who adopt side-hustles while being in schools or in employment. Therefore, “The Number” is one that keeps on growing and changing and needs constant updating.

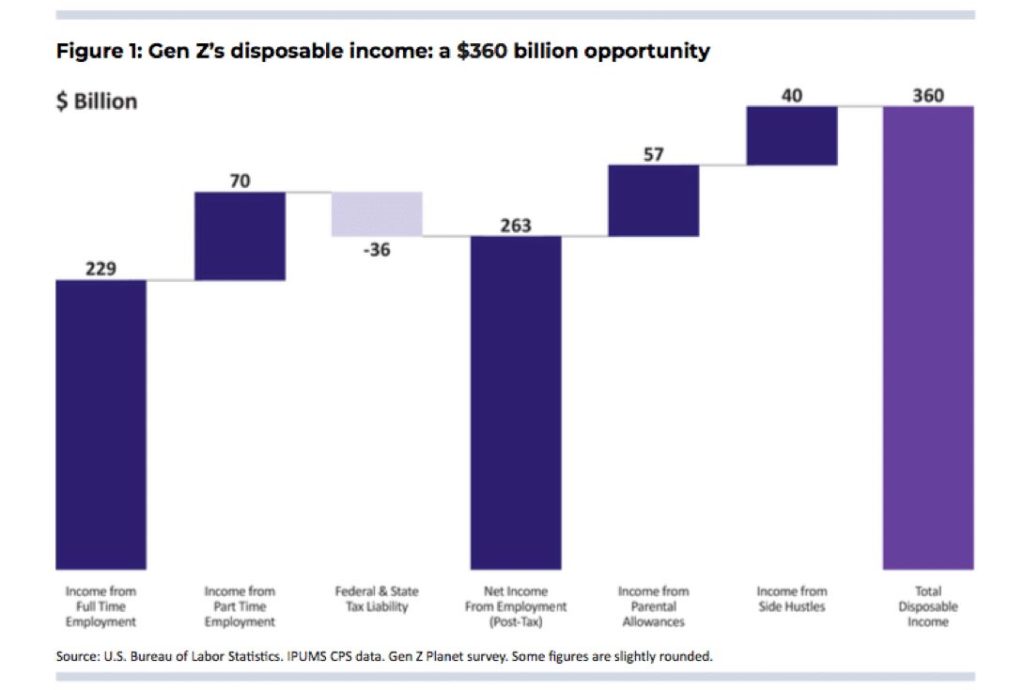

With this question in mind, we launched some research and analysis of our own to provide an updated figure for Gen Z spending power. The results were both surprising and illuminating. We discovered that the number has reached a whopping $360 billion in 2021. This number is the sum of money Gen Zers between the ages of 16–23 generate from full-time or part-time employment, parental support, or by cunning side hustles. In addition, younger Gen Zers generate some additional power through the regular allowances they receive (See Figure 1). With a figure this big, marketers looking for the next big opportunity need look no further.

So, what do they do with the money?

It’s a common assumption that due to their age, Gen Zers are careless with money. Always living life in the moment and spending with careless abandon. The truth couldn’t be more different. And the reason is simple. Gen Zers grew up during the 2008 recession, often watching their parents lose jobs and struggle to keep up with mortgage payments; it stands to reason they’d be anxious it could happen to them too. More recently of course, they have felt the economic impact of COVID-19. The result of all this is that Gen Zers are in fact cautious, calculated, and long-term oriented. And far, far more interested in securing their financial future than investing in the latest iPhone or pair of Yeezys.

Eighty five percent of Gen Zers we surveyed told us that they save between a quarter to half of the money they earn or receive from their parents, with an average of 32% savings. While most of these savings are kept in regular saving accounts, there is an increasing number of tech and future-minded Gen Zers investing their money in the stock market (26%), retirement accounts (14%), and even NFTs (6%).

While their fiscal prudence is to be commended, it doesn’t mean that Gen Zers have every cent tied up in savings and retirement accounts. Far from it. Like any generation, they’re partial to the odd shopping spree and big-ticket purchase. When we asked our research participants to indicate where they spend most of their money, the top three categories were groceries, eating out, and clothing followed by entertainment and housing cost – a consumption pattern that reflects the return to college or to the office (and thereby to their own pads), after a long period of disruption due to the COVID-19 pandemic during which many Gen Zers went back to live with their parents.

What do they want from brands?

Like Millennials before them, Gen Zers face the very real danger of being misunderstood and overlooked. Brands, marketers, and retailers have first and foremost to understand Gen Z’s money mindset, but affordable prices and good value for money alone are insufficient. Gen Z consumers have complex set of needs and wants they value purpose driven brands; diversity and inclusion in product and advertising; inspiring content, unique experiences online and in-store, and being part of the brand conversation through brand communities or ongoing engagement.

Simply put, brands, marketers and retailers can’t afford to ignore Gen Z. Are you ready for the next generation?

Download the full report https://genzplanet.com/book-reports/#smtm