“We are living in the age of attention inequality.” That’s what Zach Schwitzky, CEO of…

Home Sweet Home

Gen Z’s favorable view of homeownership is set to create a new housing market reality.

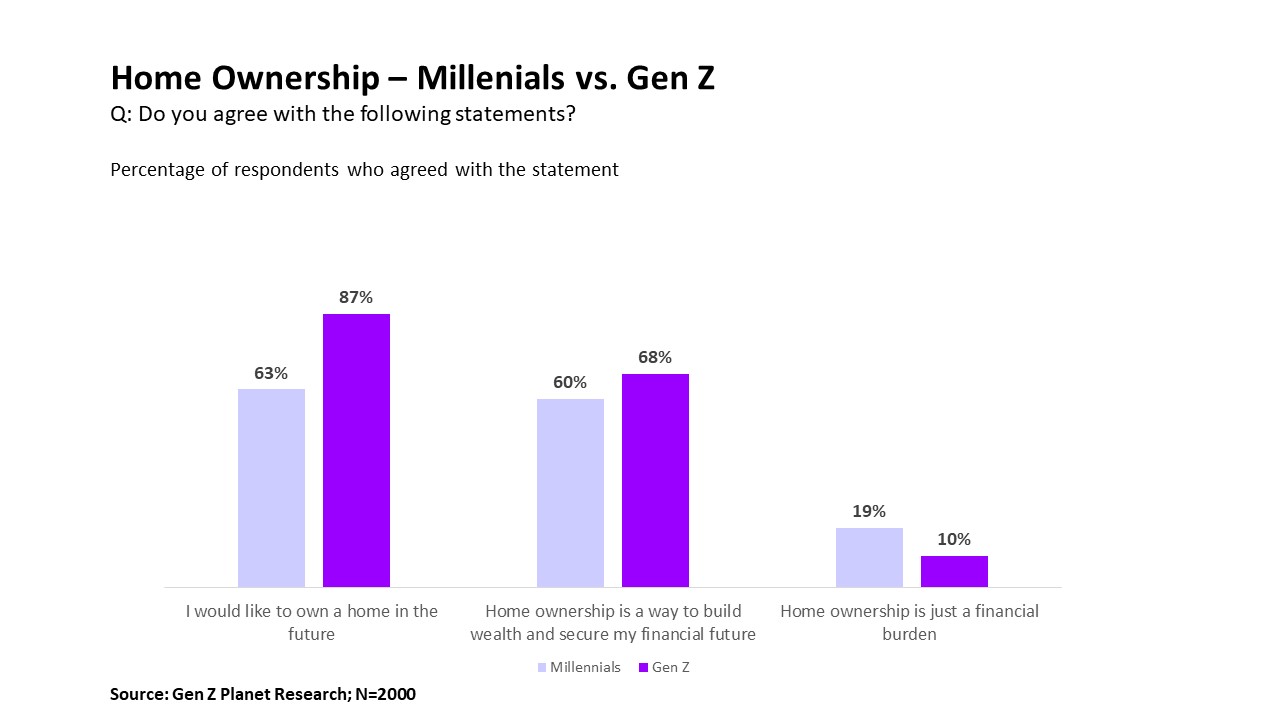

After years of headlines highlighting how Millennials were delaying homeownership, we are now facing a new reality in which young Gen Zers are not only having a favorable view of owning a home but are also taking steps to realize that ambition. Eighty seven percent of Gen Z say that they want to own a home at one point in the future compared to 63 percent of Millennials, only 10 percent view homeownership as a liability (See Chart Below), and 30 percent are actively saving toward a home purchase. Data from Better Mortgage indicate that “Gen-Z applications at Better increased 57% from January to March 2021, and was up 124% compared to March 2020”.

So, what has happened? How have we ended up with such different attitudes from these two consecutive generations?

Different Generations… Different Reactions…

The answer is most likely rooted in how different people or generations respond to the circumstances that surround them. Millennials, who found themselves with high student loan debt and difficulty finding suitable jobs as young adults responded with a more risk-averse attitude toward their finances,. They delayed or questioned the need for homeownership and they, generally speaking, avoid debt and investments in equity. In fact, one study by Black Rock shows that Millennials keep 65 percent of their assets in cash because they fear a catastrophic market event compared to the national average of 58 percent).

Gen Zers, on the other hand, who are no strangers to financial difficulties or challenges, are reacting differently. As kids, during the 2008 recession, they witnessed their parents dealing with the loss of a job or a home or with the anxiety that these things might happen. And more recently Zers are experiencing the economic effects of the global pandemic. Yet, their reaction seems to be one of a calculated risk taking.

Gen Zers are determined to learn from the mistakes of others and secure their financial future as early as possible. They have adopted financial security as a core value and as a result are inclined to save more, take on “side-hustles”, and view favorably investments that could aid their wealth building including homeownership.

Different Circumstances…

In addition, Gen Z is growing up at a time when some market circumstances as well as social and cultural trends help their aspiration for homeownership. In my book Gen Z 360, I outlined some of these trends:

- Favorable interest rates

- Work from Home culture

Gen Zers believe that they can live in affordable locations while working for companies that are located in cities that they could not afford otherwise. For example; working for a company in NYC while doing most of the work from Austin, Texas is a scenario I often hear about from Gen Zers.

- Shift in employer benefits

Some employers, in an effort to attract the best talent, started to offer tuition reimbursement. This could mean that the burden of student loans for Gen Z may not be as severe as it was for Millennials, allowing them to divert their money toward other investments including housing.

- AirBnB culture

The cultural acceptance of renting a room in one’s house makes many Gen Zers believe that they can offset some of their mortgage cost by renting a room.

- Willingness to compromise

Millennials, are unwilling to compromise on quality and space. After delaying homeownership for so long they feel that they are too old to “rough it” and seek “ready to move in” homes. Gen Zers, however, are willing to consider older homes and smaller spaces that they can put their mark on and add value to. For these creative digital natives renovating a place is full of creative opportunities (TikToK, the Gen Z playground has 6.7 billion views of videos with the hashtag #homeimprovement).

So while the pandemic may put some of Gen Z’s aspirations on hold for a short while, the fundamental way they think about owning a home is here to stay. And with Millennials homebuying finally in a full swing, we can potentially see a new housing market reality in which both Millennials and Gen Zers are driving different parts of the market.

Gen Z is Changing Everything!